Revision Lecture 11

International Tax Issues

International Taxation

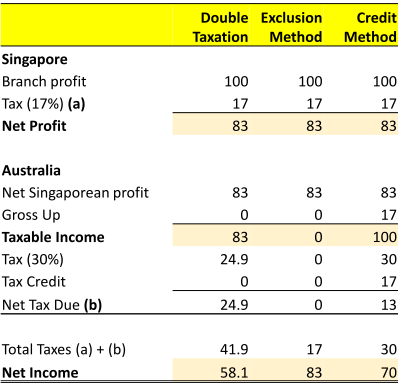

- Ways in which profits of foreign entities of domestic

(Australian) firms can be treated for tax purposes

Tax Neutrality

- A tax scheme is tax neutral if it meets three criteria:

- Capital import neutrality (exclusion method): the tax burden on an MNC subsidiary should be the same regardless of where in the world the MNC in incorporated.

- Capital export neutrality (credit method): the tax scheme does not incentivize citizens to move their money abroad.

- National neutrality: taxable income is taxed in the same manner by the taxpayer’s national tax authorities regardless of where in the world it is earned.

Types of Taxation

- (Corporate) Income tax

- An income tax is a direct tax, or a tax that is paid directly by the taxpayer upon whom it is levied.

- Withholding tax

- Tax on passive income like dividends, interest, royalties

- Tax treaty between Australia & US means, American investors are subject to 10% withholding tax on dividends they receive. This tax would be rebated as a tax credit in their home jurisdiction (i.e., the US).

- Value-added tax/Goods & Services Tax

Withholding Tax

- Withholding taxes are withheld from the payments a corporation makes to the taxpayer.

- The taxes are levied on passive income earned by an individual or corporation of one country within the tax jurisdiction of another country.

- Passive income includes income from dividends and interest, royalties, patents, or copyrights.

- In Australia, the tax on dividends is 15% (may depend on tax treaty), on royalties/patents/copyright it is 5%

- A withholding tax is an indirect tax.

Value-Added Tax

- A value-added tax (e.g. GST in Australia) is an indirect national tax levied on the value added in production of a good or service.

- It is an indirect tax.

- In terms of incentives, GST/VAT differs from corporate taxes

- An income tax has the incentive effect of discouraging work.

- A GST/VAT has the incentive effect of discouraging consumption (thereby encouraging saving.)

- GST is easier to administer. It is 10% in Australia.

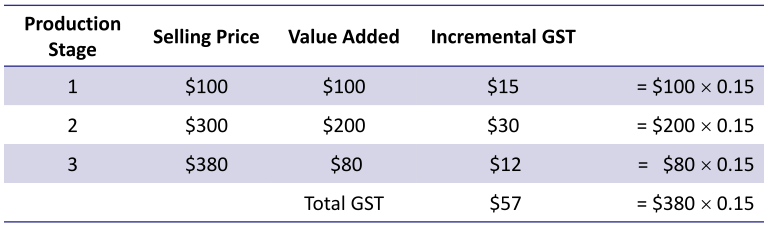

Value-added tax calculation

- Assume the tax rate is 15%. Suppose that stage one is the sale of raw materials to the manufacturer, stage two is the sale of finished goods to the retailer, and stage three is the sale of inventory from the retailer to the consumer.

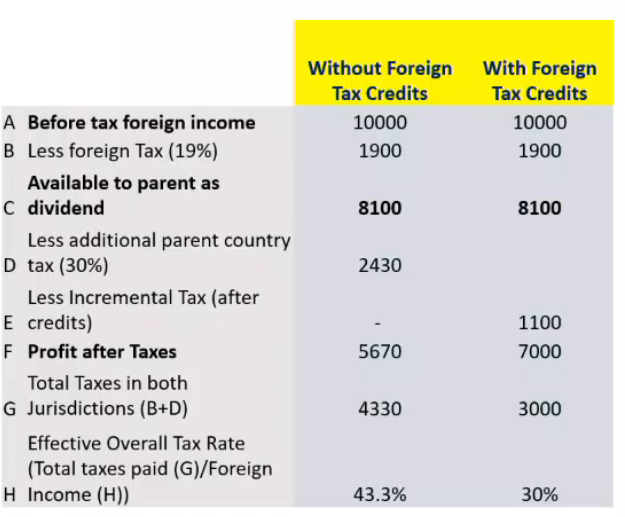

Foreign Tax Credits

- Allow taxpayers to recover somewhat from double taxation.

- It’s a direct reduction of taxes that would otherwise be due and payable.

- Direct foreign tax credits are computed for direct taxes paid on active foreign-source income of a foreign branch of a U.S. MNC or on withholding taxes withheld from passive income.

- Indirect foreign tax credits are for income taxes deemed paid by the subsidiary.

Foreign Tax Credit Example

- Assume that an Australian firm has a subsidiary in the UK. UK (Australian) corporate tax rate is 19% (30%).

Branch vs Subsidiary Income

- An overseas affiliate of a MNC can be organized as a branch or a subsidiary.

- A foreign branch is not an independently incorporated firm separate from the parent.

- Branch income passes directly through to the parent’s income statements.

- A foreign subsidiary is an affiliate organization of the MNC that is independently incorporated.

- Income may not be taxed in the U.S. until it is repatriated, under certain circumstances.

Transfer Pricing

- Having foreign affiliates offers transfer price tax arbitrage strategies.

- The transfer price is the accounting value assigned to a good or service as it is transferred from one affiliate to another.

- See Lecture 8 example (worksheet “Payments to Parent”)

- It is a method of transferring funds out of the foreign subsidiary

- If one country has high taxes, don’t recognize income there— have those affiliates pay high transfer prices.

- If one country has low taxes, recognize income there— have those affiliates pay low transfer prices.

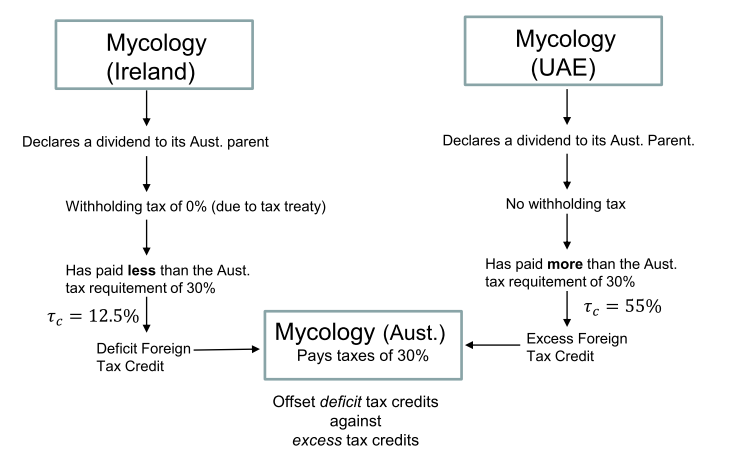

Cross crediting

- The ability of cross-credit is valuable

- It involves offsetting foreign tax credits with foreign tax deficits in the same period

Corporate Inversion

- A Corporate inversion is the changing of a country’s

country of incorporation.

- By reincorporating in a lower-tax jurisdiction firms

reduce their global tax liabilities.

- All it is is a new corporate home.

- Rules have been put in place to prevent naked

inversions. They allow for inversions when

- Substantial business presence

- Merger with a larger foreign firm

- Merger with a smaller foreign firm